Progress Software Corporation

(Name of Registrant as Specified inIn Its Charter)

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, | |

| Definitive Proxy Statement | ||

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Progress Software Corporation

(Name of Registrant as Specified inIn Its Charter)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||||||||||

| No fee | ||||||||||

| ☐ | ||||||||||

| Fee paid previously with preliminary | ||||||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act | |||||||

2023 Notice of Annual

Meeting & Proxy Statement

Progress Software Corporation

15 Wayside Road, Suite 400

Burlington, MA 01803

Our Values:

ProgressPROUD

Our values drive our everyday, keeping us connected, inspired and moving forward.

ProgressPROUD represents the fundamental beliefs that guide our actions and are core to who we are. Our values revolve around trust, collaboration, accountability, adaptability and respect. Our adherence to these values reinforces who Progress is as an employer and trusted software provider.

P PROGRESS collaboratively | R RESPECT differences and diversity | O OWN our tomorrow today | U UPHOLD trust | D DARE to innovate | ||||||||||||||

Close relationships and spirited teamwork move us forward. | Distinct viewpoints and backgrounds improve our work, culture and success. | Our initiative, seen through to completion, secures future results. | Consistently keeping our promises earns loyalty. | Our bold thinking drives tomorrow’s breakthroughs. | ||||||||||||||

| ||||||||||||||||||

| ||||||||||||||||||

| ||||||||||||||||||

|  | |||||||||||||||||

About Progress Est. 1981 NASDAQ: PRGS Headquartered in Offices across North America, Europe, Latin America and 2,300+ employees | |||||

| March 29, 2023 To Our Shareholders: We invite you to attend the The Annual Meeting will Voting” in the accompanying Proxy Statement. The following Notice of Your vote is important. Whether or not you plan to attend the Annual Meeting, We will also provide On behalf of the Board of Directors, thank you for your continued support. We look forward to seeing many of you at the virtual Annual Meeting.

John R. Egan Board | ||||

| 2023 Proxy Statement | 1 |

This past year presented unprecedented businessas the world emerged from COVID lockdowns, new geopolitical tensions and societal challengeseconomic volatility arose on a global scale. The global health crisisFrom conflict in Ukraine, to rising inflation rates and volatile market environment caused by the COVID-19 pandemic was a stark reminder to allcontinuation of the prioritygreat resignation, 2022 presented more than its share of ensuring the healthbusiness and safety of our customers, partners, employees,societal challenges. Progress remained strong in this worsening global environment with steady demand across virtually all markets and stockholders. Progress was able to successfully respond quicklyproduct lines. Active employee engagement and nimblypositive employee experience levels contributed to the rapidly changing environment,retention of strong teams which executed well throughout the year and transitioned its entire workforce to work from home by mid-March. The responsedelivered results ahead of our employees, customers and partners could not have been more gratifying.

The Board is encouraged that despite the challenges in 2020,2022, Progress never wavered in its devotion to business continuity, customer commitment, resiliency and delivering sustainable stockholder value. Throughout the year, the Board and executive leadership collaborated closely to ensure that Progress met its commitments and the financial, strategic and business results delivered in fiscal 20202022 bore this out.

Our Performance

In fiscal 2020,2022, we further advanced our strategic plan of delivering meaningful stockholder value through our total growth strategyTotal Growth Strategy while delivering solid financial annual results. In October, we acquired Chef Software, a leader in the DevOpsOur business across core and DevSecOps markets. The Chef acquisition bolsters our recurring revenue, earnings and cash flow and meets our strict acquisition financial criteria. The Chef acquisition follows on the footsteps of our acquisition and integration of Ipswitch in 2019. These successful acquisitions show that the total growth strategy is working and that by remaining disciplined, we will deliver meaningful stockholder value over the long-term.

Corporate Social Responsibility

The Board is enormously proud of how Progress and its employees performed, not just in their day to dayday-to-day responsibilities, but in their commitment to advancing our Corporate Social Responsibility Program emphasizing an inclusiveprogram, Progress for Tomorrow, which focuses on building a culture focused on inclusion, diversity and diverse environment,belonging, supporting the communities in which we live and driving sustainability and philanthropy.

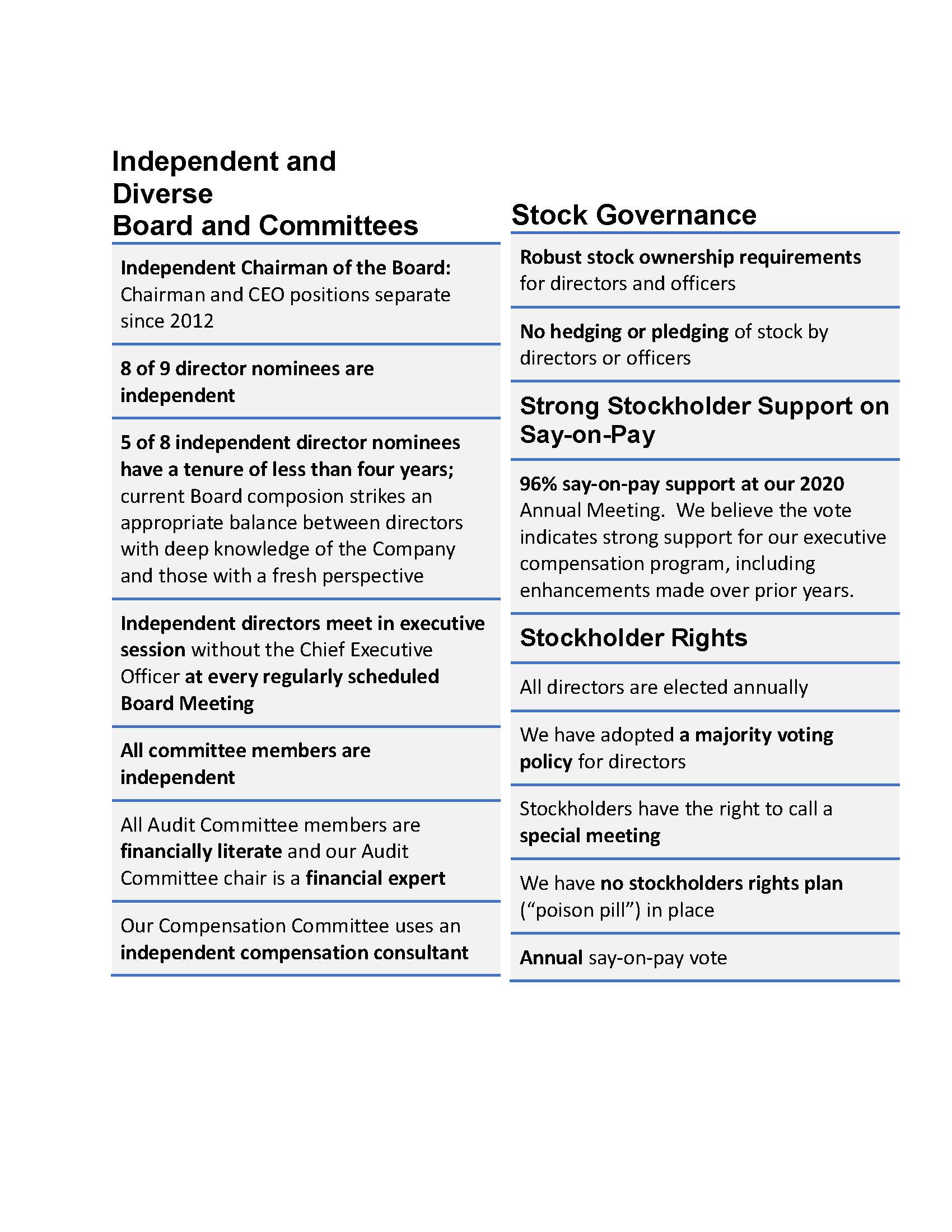

Corporate Governance

This year’s Board nominees represent a wide range of backgrounds and expertise. We believe our diversity of experiences, perspectives and skills contributes to the Board’s effectiveness in managing risk and providing guidance that positions Progress for long-term success in a dynamically changing business environment. Of our 9nine Board nominees, 8eight are independent, which includes our Board Chair and all Committee members. ThisThis Proxy Statement describes Progress’ corporate governance policies and practices that foster the Board’s effective oversight of the Company’s business strategies and practices.

Consistent with our pay-for-performance philosophy, the Compensation Committee emphasized alignment with our long-term business goals in designing our executive compensation programs for 2020.2022. Our executive compensation programs for 20202022 reflected management’s continued commitment to our strategic plan.

Looking Ahead

For fiscal 2021,2023, the Board looks forward to advancing the company’sCompany’s strategic plan. We are cognizant of the challenges and uncertainty posed by COVID-19increasing volatility in the global markets in achieving company goals but rest assured, your Board remainsremain diligent in our work and focused on its work.

Thank you for your ongoing support for our vision for the future and– we appreciate the opportunity to represent your interests as stockholders.

| 2 |  |

You are cordially invited to attend the annual meeting online.

Voting Items

| Proposals | Board Vote Recommendation | For Further Details | |||||||

| “FOR” each director nominee | Page 15 | ||||||||

| Advisory vote to approve the fiscal | “FOR” | Page 46 | |||||||

| Advisory vote on the frequency of “say-on-pay” votes | “ONE YEAR” | Page 83 | |||||||

| 4 | Approve an increase in the number of shares authorized for issuance under the 1991 Employee Stock Purchase Plan | “FOR” | Page 84 | ||||||

| Ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for our current fiscal year | “FOR” | Page 88 | |||||||

Other matters properly brought before the meeting may also be considered.

Please vote your shares before the meeting, even if you plan to attend the meeting online.meeting. Further information about how to attend the virtual Annual Meeting, online, vote your shares online during the meeting and submit questions online during the meeting is included in the accompanying proxy statement.

Your broker will not be able to vote your shares on the election of directors, the say-on-pay vote, the frequency of say-on-pay vote or the approval of an increase in the number of shares authorized for issuance under the 2008 Plan or the increase in the number of shares authorized under the ESPP, unless you give your broker specific instructions to do so. A complete list of registered stockholdersshareholders will be available for examination during the Annual Meeting at

By Order of the Board of Directors,

YuFan Stephanie Wang

Secretary

Burlington, Massachusetts

March 29, 2023

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the meeting, please promptly vote and submit your proxy.

Date and Time

Day, May 11, 2023

10:00 AM ET

Virtual Meeting

www.virtualshareholdermeeting. com/PRGS2023

Who Can Vote

Shareholders as of March 15, 2023, are entitled to vote

How to Vote

Internet

www.proxyvote.com

Telephone

1-800-690-6903

Complete, sign and promptly mail the proxy card in the enclosed postage-prepaid envelope

During the Meeting

www.virtualshareholdermeeting. com/PRGS2023

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on May 11, 2023: This Proxy Statement and our 2022 Annual Report on Form 10-K are available at: www.proxyvote.com

| 2023 Proxy Statement | 3 |

| 4 |  |

Table of Contents

| 2023 Proxy Statement | 5 |

Hundreds of thousands of enterprises, including 1,700 software companies and 3.5 million developers, depend on us to achieve their goals—with confidence. | Dedicated to propelling business forward in a technology-driven world, Progress helps businesses drive faster cycles of innovation, fuel momentum and accelerate their path to success. As the trusted provider of the best products to develop, deploy and manage high-impact applications, we enable customers to develop the applications and experiences they need, deploy where and how they want and manage it all safely and securely. Our strategic plan continues to produce results and is centered around our Total Growth Strategy, the three-pillar approach focused on: investing and innovating in our current product portfolio, customer retention and growth through accretive acquisition. |

Our Strategy

Trusted Provider of the Best Products to Develop, Deploy and Manage High-Impact Applications ● A key element of our strategy is centered on providing the platform and tools enterprises need to develop, deploy and manage modern, strategic business applications. We offer these products and tools to both new customers and partners as well as our existing partner and customer ecosystems. This strategy builds on our vast experience in application development that we’ve acquired over the past 40 years. | Focus on Customer and Partner Retention to Drive Recurring Revenue and Profitability ● Our organizational philosophy and operating principles focus primarily on customer and partner retention and success, and a streamlined operating approach to more efficiently drive predictable and stable recurring revenue and high levels of profitability. | |

|  | |

M&A Driven Growth ● We are pursuing growth driven by accretive acquisitions of businesses within the infrastructure software space, with products that appeal to both IT organizations and individual developers. ● These acquisitions must meet strict financial and other criteria, with the goal of driving significant stockholder returns by providing scale and increased cash flows. ● In April 2019, we acquired Ipswitch, Inc. and in October 2020, we acquired Chef Software, Inc. and in November 2021, we acquired Kemp Technologies and in January 2023, we acquired MarkLogic Corporation. These acquisitions met our strict financial criteria. | Thoughtful Capital Allocation Strategy ● Our capital allocation policy emphasizes accretive M&A, which allows us to expand our business and drive significant stockholder returns, and utilizes share repurchases and dividends to return capital to shareholders. ● We intend to repurchase our shares in sufficient quantities to offset dilution from our equity plans. Lastly, we return a significant portion of our annual cash flows from operations to shareholders in the form of dividends. | |

|  | |

| 6 |  |

Business Overview

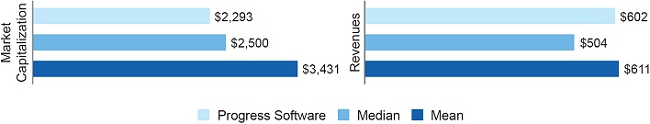

Fiscal 2022 Financial Highlights*

Cash Flow from Operations $192M

| Revenue $602M

| Operating Income $132M

| ||

Adjusted Free Cash $189M

| Non-GAAP $611M

| Non-GAAP Operating $242M

| ||

Annualized Recurring $497M

| Diluted EPS $2.15

| Operating Margin 22% (Flat) YoY | ||

Dividends $31M Paid directly to shareholders | Non-GAAP Diluted $4.13

| Non-GAAP Operating 40%

|

| * | Please refer to Appendix A for reconciliations of GAAP to Non-GAAP selected financial measures |

| 2023 Proxy Statement | 7 |

Business Overview

Praise for Progress

We are proud to share that our company and its leaders continue to be recognized by the industry as a “Best Employer” and for our corporate social responsibility work, including our efforts to be an inclusive organization.

| 8 |  |

Business Overview

Corporate Social Responsibility

In 2022, Progress and our employees provided close to half a million dollars in donations, supplies and volunteer hours to over 130 organizations worldwide. Inside our walls, we expanded our Employee Resource Groups, held 55 inclusive trainings to foster leadership and reduce bias, granted a one-time bonus to reduce economic stressors and advanced the work of our Earth Team to ensure a more sustainable future.

Environment ● Established programs including the “Small Sustainability Steps Challenge,” offering monthly challenges for Progressers to better integrate sustainability into business practices. ● Extended our carbon impact initiative by tracking company vehicle footprints, as well as the impact of our servers used in off-site data centers. ● Advanced sustainability practices by discontinuing the purchase and usage of plastic cups and utensils across Progress offices. | Inclusion and Diversity ● Hosted Inclusion and Diversity training on inclusive leadership and psychological safety. ● Earned recognition from The Boston Club as one of only nine of the largest 100 publicly traded companies in Massachusetts with a “critical mass of women directors and executive officers.” ● Expanded Employee Resource Groups (ERGs) to include ENABLE, which supports people with differing abilities. | |

|

| |

Employee Engagement ● Added a new commitment to our U.S. health plan to reimburse all U.S. employees for travel expenses to receive healthcare services not available in their home state. ● Continued Progress’ position as a “Best Employer,” receiving new recognitions from leading industry organizations including Forbes, Inc., The Boston Globe and Boston Business Journal. ● Granted a one-time bonus of approximately one week’s pay to employees, in part, to offset growing concerns about market inflation. | Community and Giving ● Progress and its employees donated close to half a million dollars in donations, supplies, volunteer hours and more to over 130 certified charitable organizations worldwide. ● Expanded our Charitable Giving Program from the U.S. to global, donating to more than 40 causes nominated by our employees, worldwide. ● Granted scholarships to four women in the U.S., Bulgaria and India, as part of our global Women in STEM Scholarship series. | |

|

| |

| 2023 Proxy Statement | 9 |

This summary highlights information contained elsewhere in this proxy statement.Proxy Statement. For more complete information about these and other topics, please review our Annual Report on Form 10-K for the fiscal year ended November 30, 20202022 (the “Annual Report”), and thethis entire Proxy Statement.

This proxy statementProxy Statement and the accompanying proxy card, including an Internet link to our previously filed Annual Report, were first made available to stockholdersshareholders on or about April 14, 2021.

| 1 | Election of Nine Directors |

The Board recommends a > See page 15 | ||

The Board of Directors and Nominating and Corporate Governance Committee believe the nine Board nominees possess the skills, experience and diversity to effectively monitor performance, provide oversight and advise management on the Company’s long-term strategy.

Director Nominees

| Director Since | Other Public Boards | Committee Membership | ||||||||||||

| Name and Primary Occupation | Age | AC | CC | NC | M&A | |||||||||

| John R. Egan Board Chair Managing Partner, Carruth Management, LLC | 65 | 2011 | 3 |  | |||||||||

| Paul T. Dacier General Counsel, Indigo Agriculture, Inc. | 65 | 2017 | 1 |  | |||||||||

| Rainer Gawlick Board Member, Proto Labs, Inc. | 55 | 2017 | 1 |  |  | ||||||||

| Yogesh Gupta President and CEO, | 62 | 2016 | 1 | ||||||||||

| Charles F. Kane Senior Lecturer, MIT Sloan | 65 | 2006 | 2 |  |  | ||||||||

| Samskriti Y. King CEO, Veracode, Inc. | 49 | 2018 | 1 |  |  | ||||||||

| David A. Krall Strategic Advisor, Roku, Inc. | 62 | 2008 | 2 |  | |||||||||

| Angela T. Tucci Chair, AnitaB.org Institute for Women and Technology | 56 | 2018 | –— |  |  | ||||||||

| Vivian Vitale, NACD.DC Principal, Vivian Vitale Consulting, LLC | 69 | 2019 | 1 |  |  | ||||||||

| AC | |||||||||||

| Nominee | Age | Director Since | Independent | Other Public Boards | Committee Membership | |||||||||||||||||||||

| AC | CC | NC | M&A | |||||||||||||||||||||||

John R. Egan, Chairman of the Board Managing Partner, Carruth Management, LLC | 63 | 2011 | Yes | 3 |  | |||||||||||||||||||||

Paul T. Dacier General Counsel, Indigo Agriculture, Inc. | 63 | 2017 | Yes | 1 |  | |||||||||||||||||||||

Rainer Gawlick Advisor, think-cell | 53 | 2017 | Yes | 1 |  |  | ||||||||||||||||||||

Yogesh Gupta President and CEO, Progress Software Corporation | 60 | 2016 | No | — | ||||||||||||||||||||||

Charles F. Kane Adjunct Professor of International Finance, MIT Sloan Graduate Business School of Management | 63 | 2006 | Yes | 1 |  |  | ||||||||||||||||||||

| ||||||||||||||||||||||||||

Samskriti Y. King CEO, Veracode, Inc. | 47 | 2018 | Yes | — |  |  | ||||||||||||||||||||

David A. Krall Strategic Advisor, Roku, Inc. | 60 | 2008 | Yes | 1 |  | |||||||||||||||||||||

Angela T. Tucci Chief Operating Officer, Uplight, Inc. | 54 | 2018 | Yes | — |  |  | ||||||||||||||||||||

Vivian Vitale Principal, Vivian Vitale Consulting, LLC | 67 | 2019 | Yes | 1 |  |  | ||||||||||||||||||||

| Chair | |||||||||||||||||||

|   | Member | ||||||||||||||||||

| Chair and Financial Expert | |||||||||||||||||||

| M | Mergers |  | Independent | |||||||||||||||||

| 10 |  |

Proxy Statement Summary

Key Board Qualifications, Expertise and Attributes

The table and graphs below summarize the director nominees’ experience and the qualifications, skills and attributes most relevant to nominate candidates to serve on the Board. The section of the proxy statement entitled See “Nominees for Directors” describesDirectors” for additional details regarding our nominees’ experience and backgrounds in more detail.backgrounds.

07 |  09 |  05 | ||||

| Cybersecurity | Leadership | Finance and Accounting | ||||

09 |  06 |  09 | ||||

| Technology/Software Industry | Go-to-Market/Sales | Strategy | ||||

05 |  09 |  09 | ||||

| Product Development | Public Company Board Service and Governance | Mergers & Acquisitions | ||||

05 |  06 | |||||

| Human Capital Management | CSR/ESG |

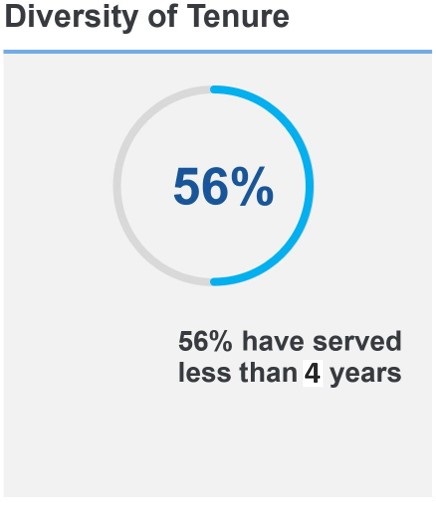

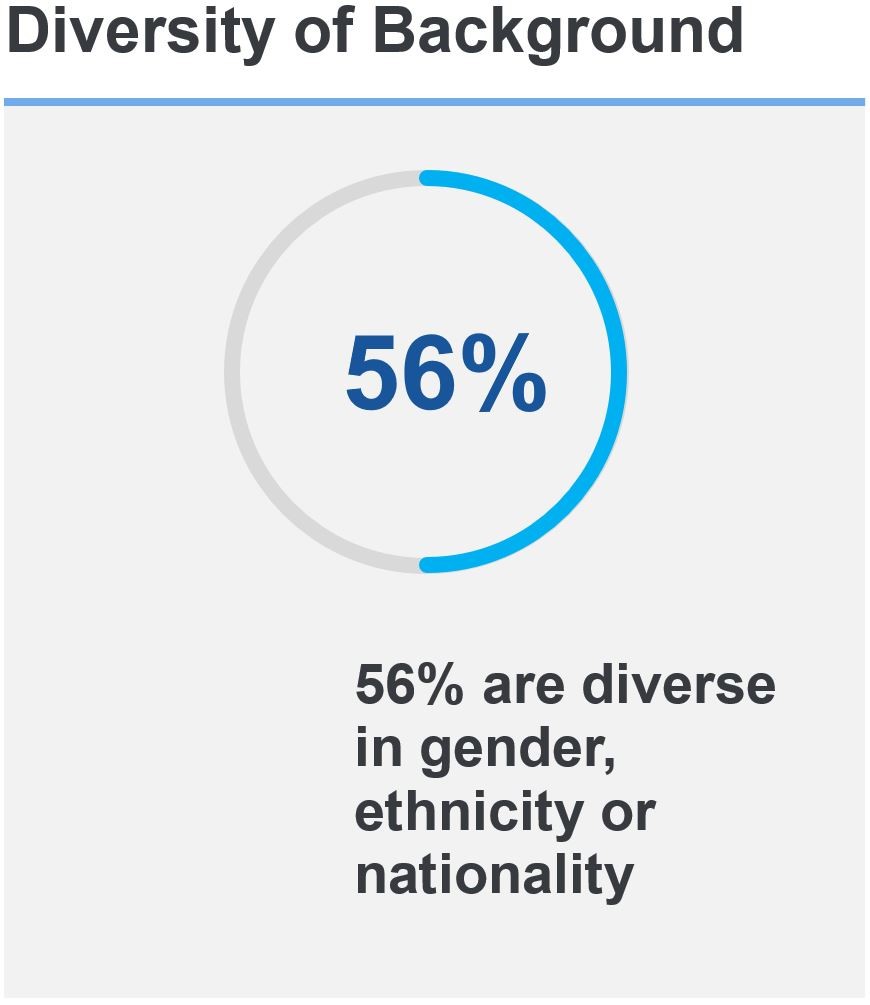

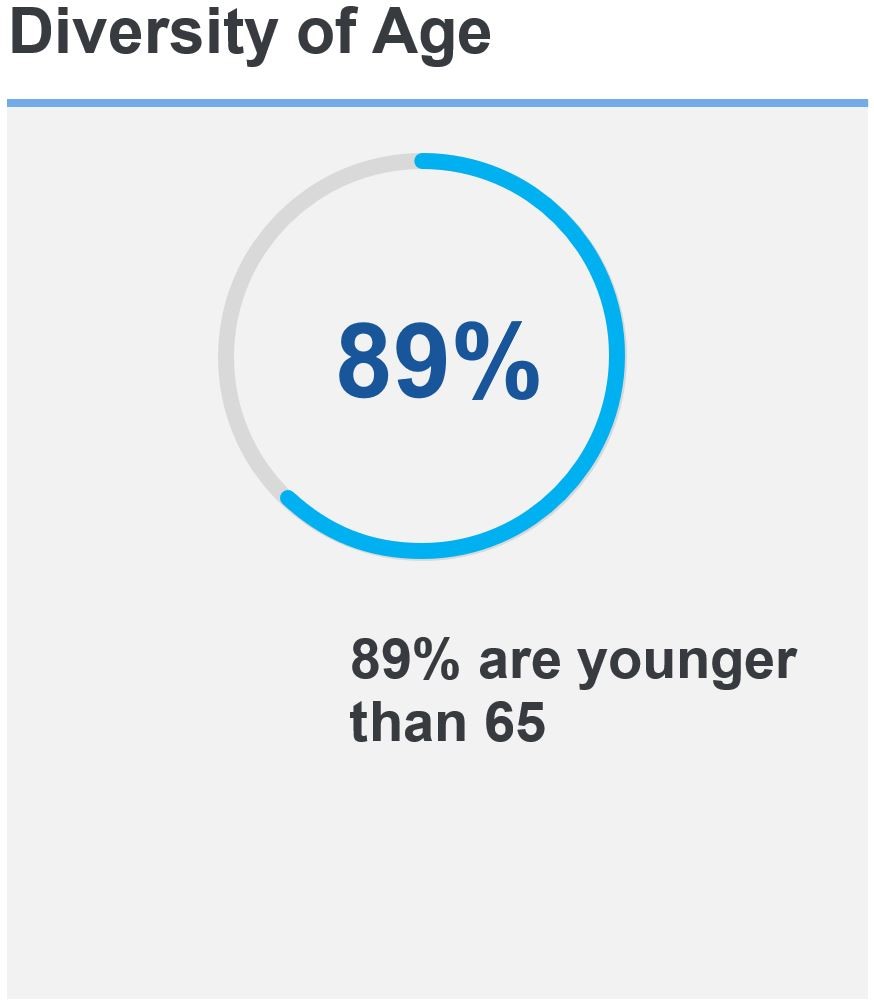

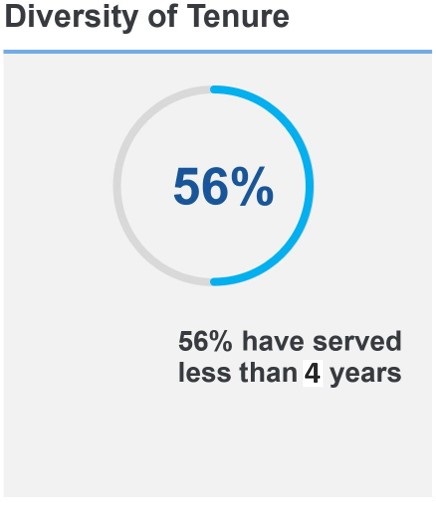

Board Snapshot

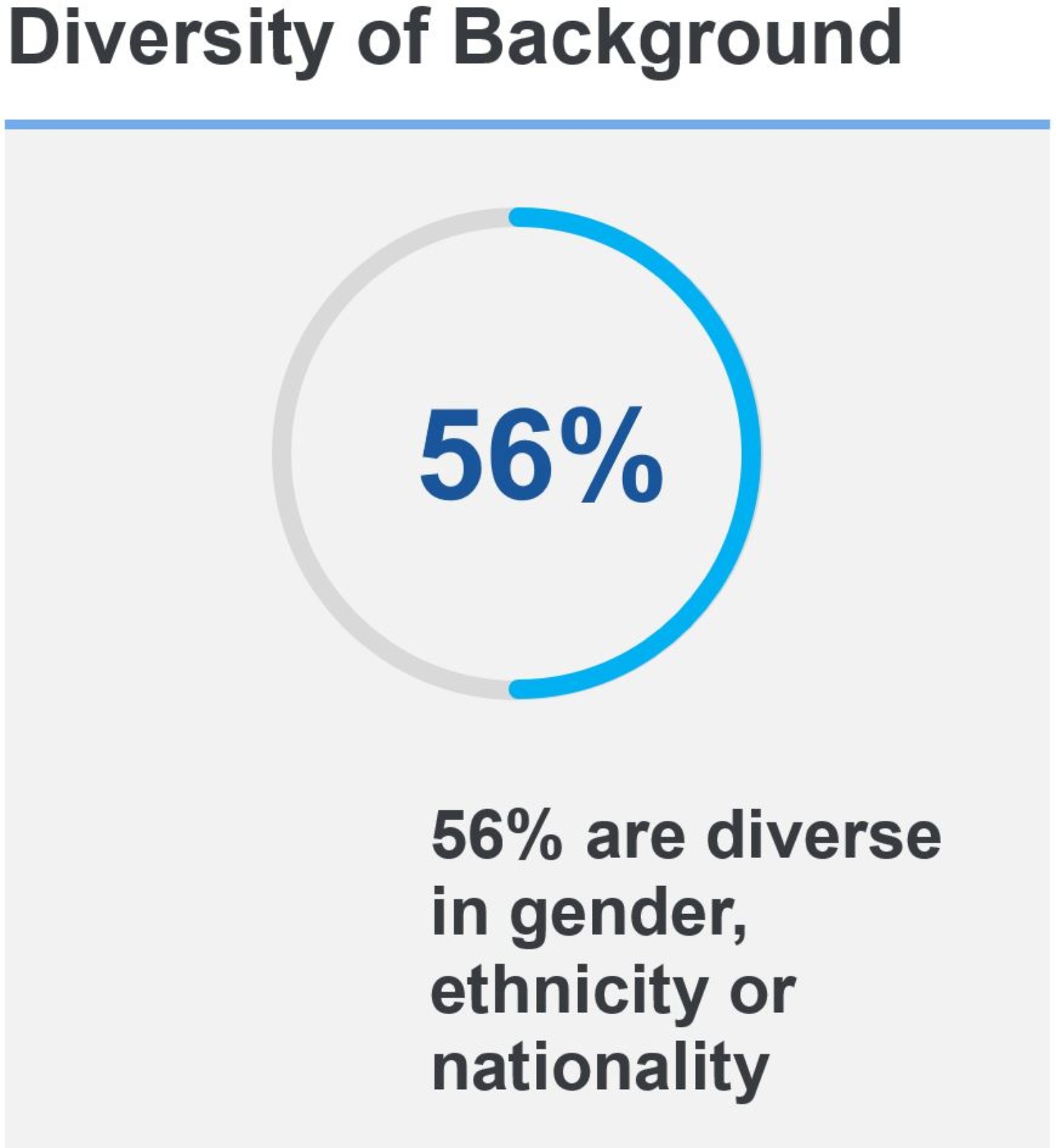

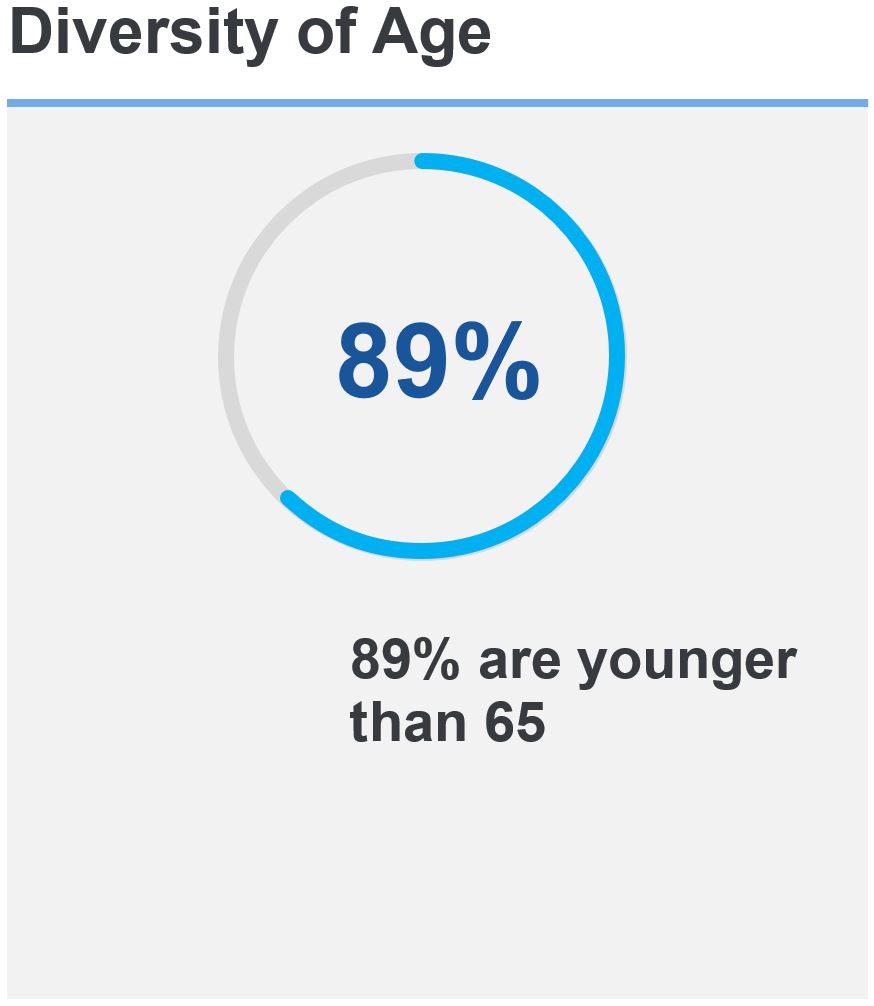

| Independence | Diversity of Tenure | Diversity of Background | Diversity of Age | |||

|  |  |  | |||

● Independent: 8 ● Not Independent: 1 | ● Shorter-term (1-5 years): 3 ● Mid-range (6-10 years): 3 ● Longer-term (>10 years): 3 | ● Diverse: 5 ● Non-Diverse: 4 | ● In 40s: 1 ● In 50s: 2 ● In 60s: 6 | |||

are independent | have served less than 8 years | 56% are diverse in gender, ethnicity or nationality | 56% are younger than 65 | |||

|

| 2023 Proxy Statement | 11 |

Proxy Statement Summary

Board Effectiveness

Our Board takes a multi-faceted approach to continually assess Board composition and evaluating the effectiveness of the Board.

Practices Contributing  Chair and CEO positions have been separate since 2012  | 8 of 9 | |||||||||||||

|  All committee members are  Independent directors meet in executive session without the | |||||||||||||

|  | |||||||||||||

| ||||||||||||||

| ||||||||||||||

| 3 of 9 | |||||||||||||

| Skills Enhanced in the  Technology/Software Industry  Cybersecurity  Go-to-Market/Sales  Strategy  Product Development  Organizational effectiveness, culture and | Meaningful  5 of 8 independent directors have a tenure of 6 | ||||||||||||

| ||||||||||||||

All directors are elected annually

|  We have adopted a director resignation policy for directors | |||||||

Active and Engaged Board

We have an active and engaged Board that is committed to fulfilling its fiduciary duty to act in good faith in the best interests of Progress and its shareholders. The number of Board and committee meetings held in fiscal year 2022 (December 1, 2021 – November 30, 2022) is set forth below.

| 2022 Meetings | |

| 5 |

| Audit Committee | |

| Nominating & Corporate Governance Committee | 3 |

| Compensation Committee | 5 |

| Mergers & Acquisitions Committee | 4 |

5 Total Board 98% Average attendance rate | 22 Total Committee meetings 100% Average attendance rate |

| 12 |  |

Proxy Statement Summary

| Proposal 2 | Advisory Vote to |

The  > See page 46 |

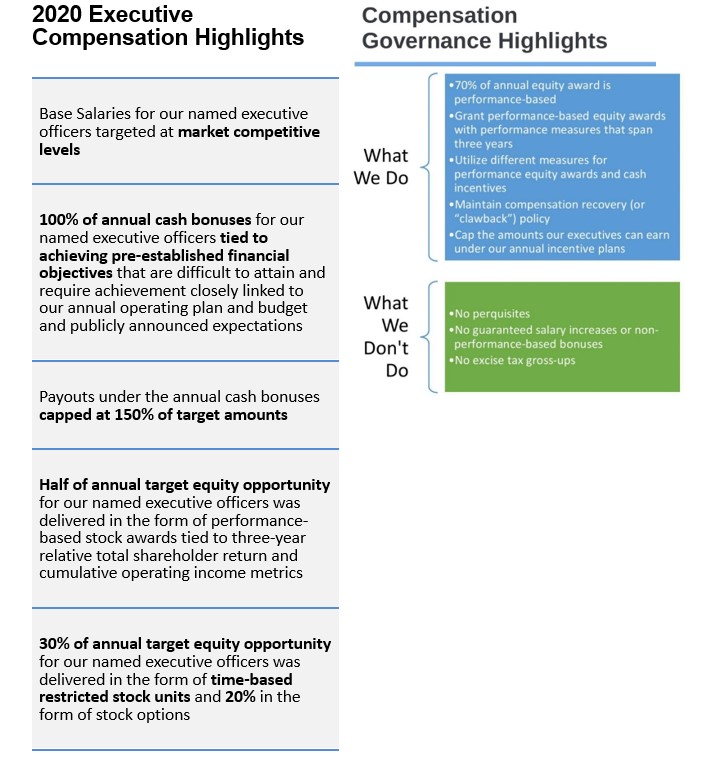

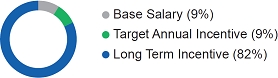

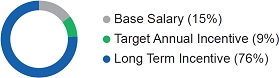

Executive Compensation Philosophy

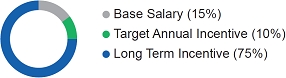

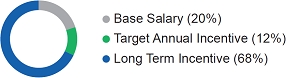

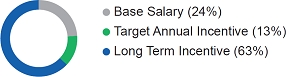

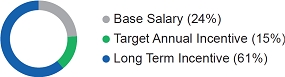

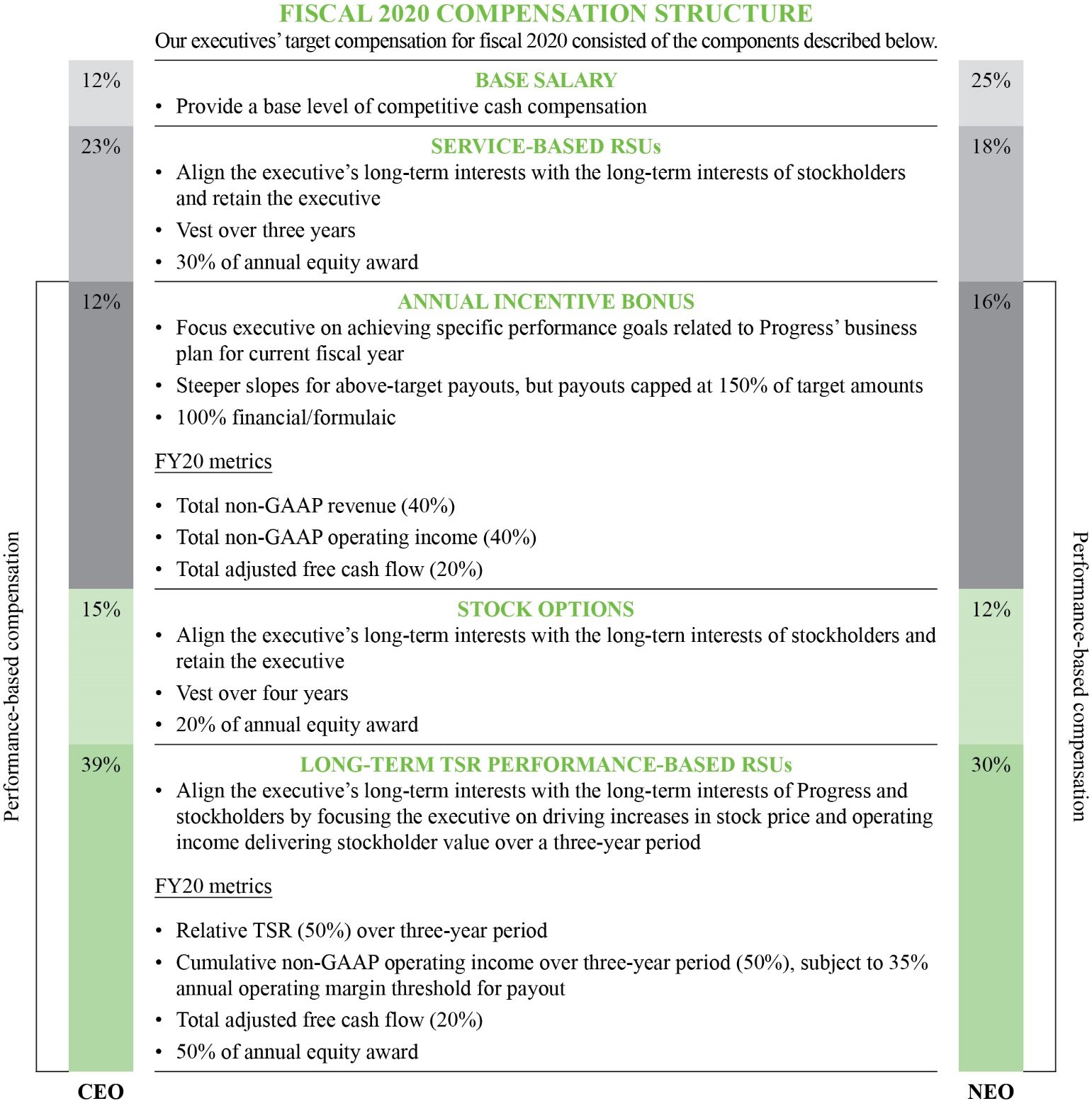

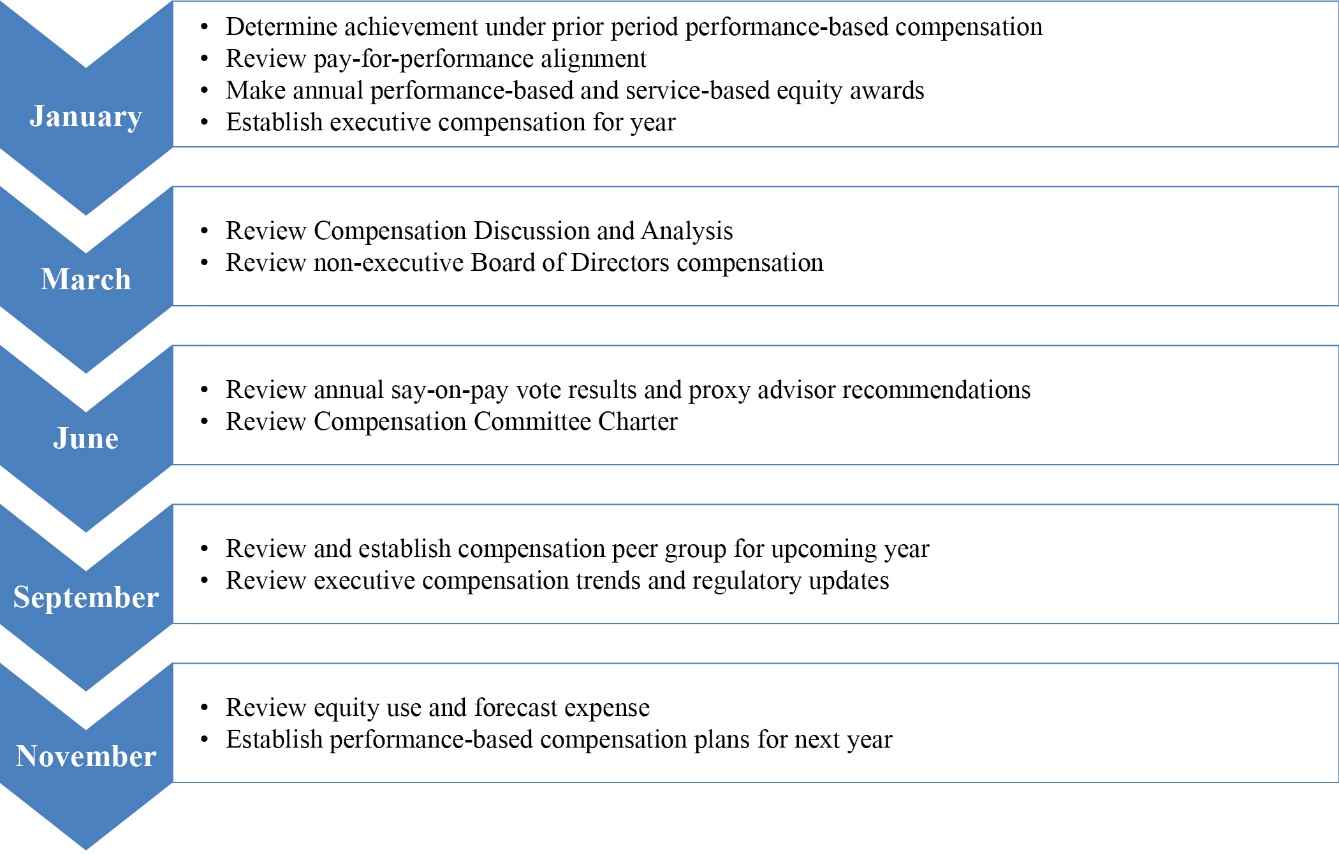

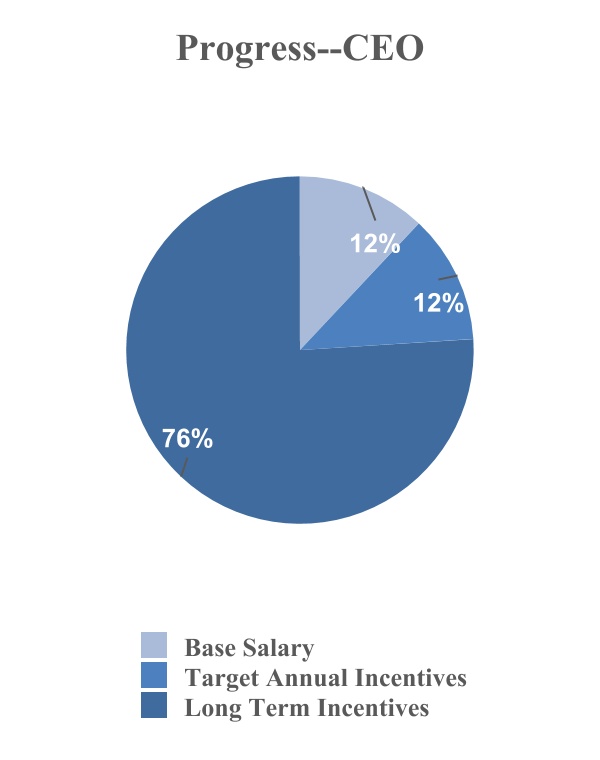

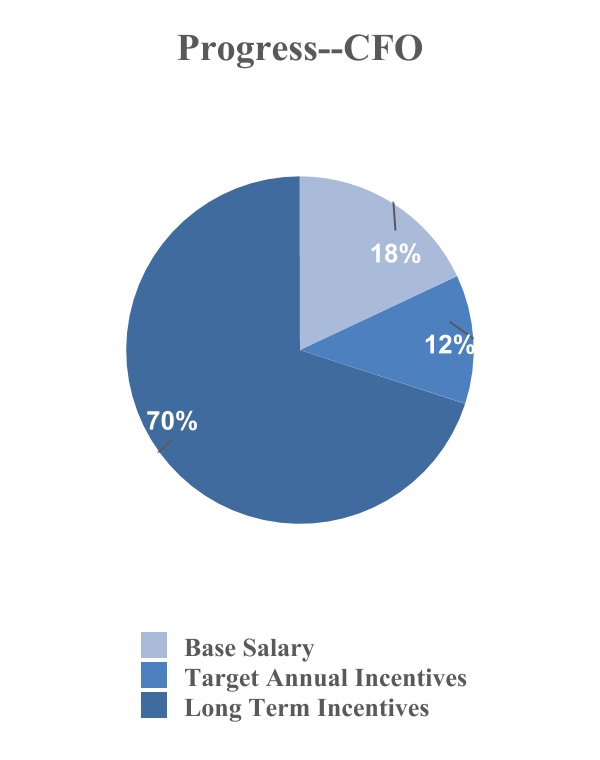

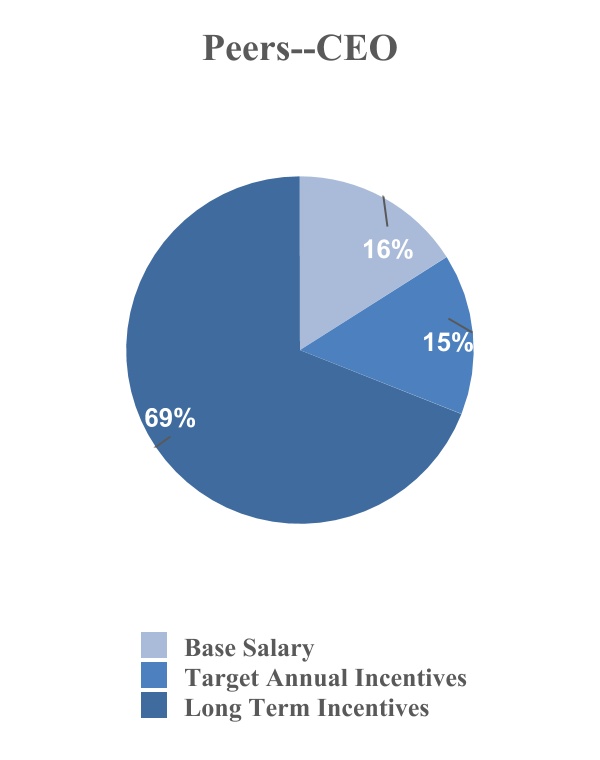

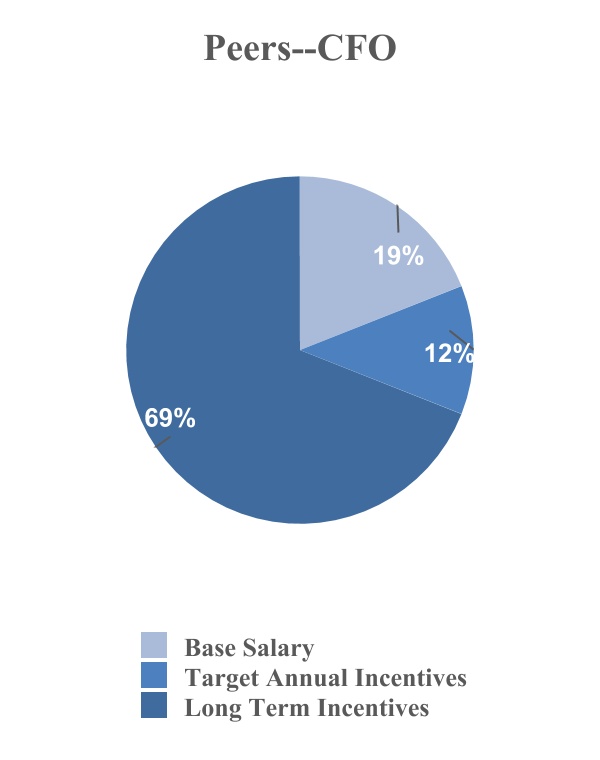

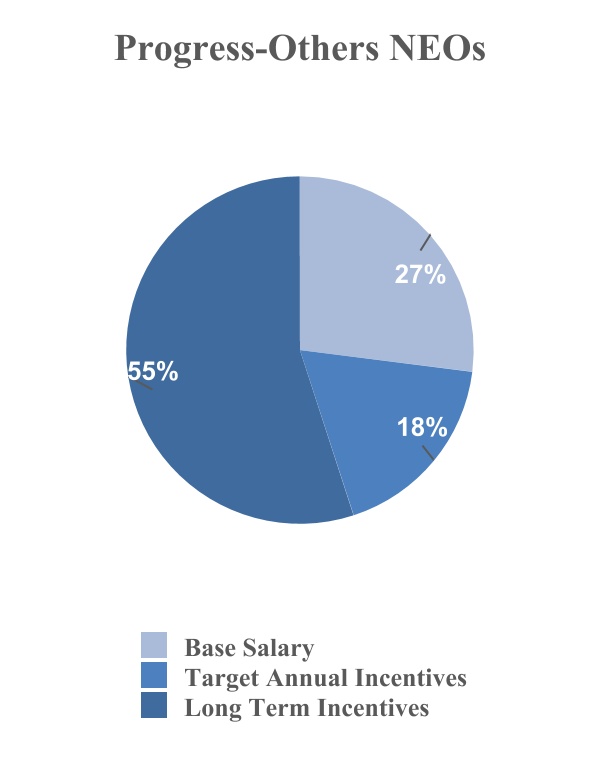

The Compensation Committee'sCommittee’s philosophy is to tie executive pay to performance to incentincentivize the achievement of outstanding returns to our stockholdersshareholders and to drive the creation of sustainable long-term stockholder value. Consistent with itsthis pay-for-performance philosophy, the Compensation Committee, in designing our executive compensation programs for 2020,2022, emphasized alignment with our long-term business goals.

2022 Executive Compensation Highlights

| ● | Base Salaries for our named executive officers targeted at market competitive levels | |

| 100% of annual | ||

Annual target equity opportunity for our named executive officers:

| ● | 70% of annual equity award is performance-based: |

| ● | 50% was delivered in the form of stock awards tied to three-year relative total shareholder return and cumulative operating income metrics | |

| ● | 20% was delivered in the form of stock options |

| ● | 30% was delivered in the form of time-based restricted stock units |

Compensation Governance Highlights

| What We Do |  | What We Don’t Do |  | |||||

Grant performance-based equity awards with performance measures that span three years  Utilize different measures for performance equity awards and cash incentives  Clawback Policy: committed to updating compensation recovery policy in line with the Security and Exchange Commission’s (the “SEC”) updated clawback rules and Nasdaq’s final listing standards  Cap the amount our executives can earn under our annual incentive plans |  No perquisites  No guaranteed salary increases or performance-based bonuses  No excise tax gross-ups | |||||||

| 2023 Proxy Statement | 13 |

Proxy Statement Summary

| Proposal 3 |

The Board recommends a vote for ONE YEAR on this proposal. > See page 83 | ||||||

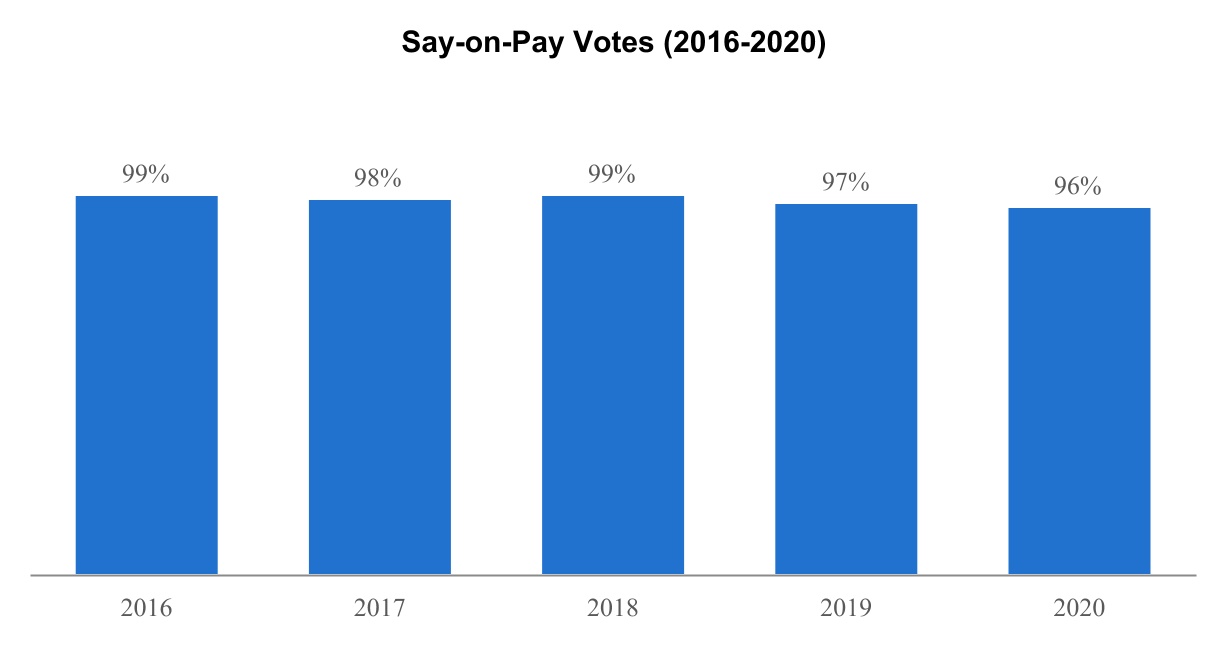

We currently hold a say-on-pay vote every year because it enables shareholders to timely vote on executive pay and pay practices, which enables us for services performed forto consider and respond to any concerns identified on a timely basis. Our Board of Directors believes it is most appropriate to retain the fiscal years ended November 30, 2020 and November 30, 2019 by our independent registered public accounting firm, Deloitte & Touche LLP, were as follows:

2020 ($) | 2019 ($) | |||||||

Audit Fees (1) | 2,414,266 | 2,117,145 | ||||||

Audit-Related Fees (2) | 270,000 | 673,700 | ||||||

Tax Fees (3) | 2,615 | 19,805 | ||||||

| All Other Fees | __ | __ | ||||||

| Proposal 4 | Approve an increase in the number of shares authorized for issuance under the 1991 Employee Stock Purchase Plan |

The Board recommends a vote FOR this proposal. > See page 84 |

We are asking our shareholders to approve an amendment to the Progress Software Corporation 1991 Employee Stock Purchase Plan, as amended and restated (the “ESPP”);

| Proposal 5 | Ratify the Selection of Deloitte & Touche LLP as Our Independent Registered Public Accounting Firm for Our Current Fiscal Year |

The Board recommends a vote FOR this proposal. > See page 88 |

Based on the record date.

| Experience and effectiveness | Strong independence controls | |

Enhanced audit quality |  Thorough Audit Committee oversight | |

Effective audit plans and efficient fee structures |  Robust pre-approval policies and limits on non-audit services | |

Maintaining continuity avoids disruption |  Deloitte’s strong internal independence procedures and regulatory framework | |

| 14 |  |

Nine individuals have the right to direct your broker, bank or nominee on how to vote and are also invited to attend the Annual Meeting online. However, since you are not the stockholder of record, you may not vote these shares onlinebeen nominated for election at the Annual Meeting unless you requestto hold office until the 2024 Annual Meeting. The nominees were evaluated and obtain a proxy from your broker, bank or nominee. Your broker, bank or nominee will provide a voting instruction card for you to use in directing the broker, bank or nominee regarding how to vote your shares.

Each director nominees are elected at the Annual Meeting will hold office until the Board will continue to be composednext Annual Meeting of one employee director (Mr. Gupta,Shareholders or special meeting in lieu of such an Annual Meeting or until their successor has been duly elected and qualified, or until their earlier death, resignation or removal. There are no family relationships among any of our CEO) and eight non-employee directors (Messrs. Egan, Dacier, Kane and Krall, Dr. Gawlick and Mses. King, Tucci and Vitale).

•Each of our directors stands for election every year. We do not have a classified or staggered board.

Our Corporate Governance Guidelines set forth our majority votingdirector resignation policy for directors, which provides that any nominee for election to the Board in an uncontested election who receives a greater number of votes “withheld” from his or hertheir election than votes “for” such election is required to submit his or hertheir offer of resignation for consideration by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is to consider all relevant facts and circumstances and recommend to the Board the action to be taken with respect to that offer of resignation. The Board will then act on the Nominating and Corporate Governance Committee’s recommendation. Promptly following the Board’s decision, the Company will disclose that decision and an explanation of such decision in a filing with the SEC or a press release.

If a director’s resignation is not accepted by the Board, such director will continue to serve until the next Annual Meeting of StockholdersShareholders or special meeting in lieu of such an Annual Meeting or until his or hertheir successor has been duly elected and qualified, or until his or hertheir earlier death, resignation or removal.

| 2023 Proxy Statement | 15 |

Proposal 1: Election of the Board and/or the Chair of the Nominating and Corporate Governance Committee, written questionnaires, or a combination of the two methods) the effectiveness of the Board and its committees, director performance and Board dynamics. The results of these self-evaluations and action items, if any, are reported to, and discussed by, the Board.

| Nominee | Age | Director Since | Occupation | ||||||||

John R. Egan, Chairman of the Board | 63 | 2011 | Managing Partner, Carruth Management, LLC | ||||||||

| Paul T. Dacier | 63 | 2017 | General Counsel, Indigo Agriculture, Inc. | ||||||||

| Rainer Gawlick | 53 | 2017 | Public/Private Company Board Member; Advisor, think-cell | ||||||||

| Yogesh Gupta | 60 | 2016 | President and CEO, Progress Software Corporation | ||||||||

| Charles F. Kane | 63 | 2006 | Adjunct Professor of International Finance, MIT Sloan Graduate Business School of Management | ||||||||

| Samskriti Y. King | 47 | 2018 | CEO, Veracode, Inc. | ||||||||

| David A. Krall | 60 | 2008 | Strategic Advisor, Roku, Inc. | ||||||||

| Angela T. Tucci | 54 | 2018 | Chief Operating Officer, Uplight, Inc. | ||||||||

| Vivian Vitale | 67 | 2019 | Principal, Vivian Vitale Consulting, LLC | ||||||||

Board Membership Criteria

Our Board of Directors has delegated the search for, and recommendation of, director nominees to the Nominating and Corporate Governance Committee. When considering a potential candidate for membership on our Board of Directors, the Nominating and Corporate Governance Committee will consider any criteria it deems appropriate, including, among other things, the background, experience and qualifications of any candidate as well as such candidate’s past or anticipated contributions to our Board of Directors and its committees. At a minimum, each nominee is expected to have:

| Highest personal and professional integrity | Demonstrated exceptional ability and judgment | with other Board members and management to serve the term interests of our | ||||||||||||

In addition, the Nominating and Corporate Governance Committee has established the following minimum requirements:

| ● | at least five years of business experience; |

| ● | no identified conflicts of interest as a prospective director; |

| ● | no convictions in a criminal proceeding (aside from traffic violations) during the five years prior to the date of selection; and |

| ● | willingness to comply with our Code of Conduct and Business Ethics. |

The Board of Directors retains the right to modify these minimum qualifications from time to time,time-to-time and exceptional candidates who do not meet these criteria may still be considered.

The Nominating and Corporate Governance Committee also considers numerous other qualities, skills and characteristics when evaluating director nominees, such as:

| Direct experience in the software industry or in the markets in which we operate | An understanding of, and experience in, accounting, legal,finance, product,sales and/ormarketing matters | Experience on other public orprivate company boards and involvement in corporate governance best practices | ||

| Leadership experience with public companies or other major organizations with a proven track record in developing and executing a strategic vision and making executive-level decisions | M&A experience around the strategic acquisition of complementary businesses while meeting strict financial criteria | Diversity of the Board, considering business and professional experience, educational background, reputation and industry expertise across various market segments and technologies relevant to our business, as well as other relevant attributes | ||

The Nominating and Corporate Governance Committee considers a variety of standards that may be appropriate from time-to-time for the overall structure and composition of our Board of Directors, but it does not assign specific weights to the various criteria and no single criterion is necessarily applicable to all prospective nominees.

| 16 |  |

Proposal 1: Election of Directors

| 1 | IDENTIFYING CANDIDATES | |

| Generally, the Nominating and Corporate Governance Committee identifies candidates for director nominees in consultation with the other directors and management, using search firms or other advisors, through recommendations submitted by shareholders or through other methods that the Nominating and Corporate Governance Committee deems to be helpful to identify candidates. | ||

| ||

| 2 | INCUMBENT DIRECTORS | |

| In the case of incumbent directors, the Nominating and Corporate Governance Committee reviews each incumbent director’s overall past service to us, including the number of meetings attended, level of participation, quality of performance and whether the director continues to meet applicable independence standards. | ||

| ||

| 3 | MINIMUM QUALIFICATIONS FOR NEW DIRECTOR CANDIDATE | |

| In the case of a new director candidate, the Nominating and Corporate Governance Committee confirms that the candidate meets the minimum qualifications for a director nominee established by the Nominating and Corporate Governance Committee. | ||

| ||

| 4 | INTERVIEWING CANDIDATES | |

| The candidate will also be interviewed by the Nominating and Corporate Governance Committee and other Board members. | ||

| ||

| 5 | EVALUATION OF CANDIDATES | |

| The Nominating and Corporate Governance Committee then meets to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and considering the overall composition and needs of our Board of Directors. The same procedures apply to all candidates for director nomination, including candidates submitted by shareholders. | ||

| ||

| 6 | RECOMMENDATION OF CANDIDATES | |

| Based on the results of the evaluation process, the Nominating and Corporate Governance Committee recommends candidates for our Board of Directors’ approval as director nominees for election to our Board of Directors. The Nominating and Corporate Governance Committee also recommends candidates to our Board of Directors for appointment to its committees. | ||

| 2023 Proxy Statement | 17 |

Proposal 1: Election of Directors

| We Value Diversity |

| The Board and the Nominating and Corporate Governance Committee value diversity of backgrounds, experience, perspectives and leadership in different fields when identifying nominees. We believe that we have assembled a diverse set of directors with the varied backgrounds, experiences and perspectives critical to our long-term success. Presently, more than half of our Board members are diverse in gender, ethnicity or nationality. Our Board of Directors conducts regular self-evaluations. The survey questions include an assessment of whether the composition of the Board is appropriately diverse and possesses the skills and experience consistent with achieving our short and long-term corporate goals. |

Stockholder Recommendations

The Nominating and Corporate Governance Committee will consider director nominee candidates who are recommended by stockholdersshareholders of our company. Recommendations sent by stockholdersshareholders must provide the following information:

| ● | the name and address of record of the stockholder; |

| ● | a representation that the stockholder is a record holder of our common stock, or if the stockholder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”); |

| ● | the name, age, business and residential address, educational background, current principal occupation or employment and principal occupation or employment for the preceding five full fiscal years of the proposed director candidate; |

| ● | a description of the qualifications and background of the proposed director candidate which addresses the minimum qualifications described above; |

| ● | a description of all arrangements or understandings between the stockholder and the proposed director candidate; and |

| ● | any other information regarding the proposed director candidate that is required to be included in a Proxy Statement filed under SEC rules. |

The submission must be accompanied by a written consent of the individual to be named in our proxy statementProxy Statement as standing for election if nominated by our Board of Directors and to serve if elected by the stockholders.shareholders. Stockholder recommendations of candidates for election as directors at an Annual Meeting of StockholdersShareholders must be timely and submitted to the Company in accordance with the requirements set forth in the Company'sCompany’s bylaws.

| 18 |  |

The table and graphs below summarize the director nominees’ experience and the qualifications, skills and attributes most relevant to nominate candidates to serve on the Board. Director biographies in the section below entitled “Nominees“Nominees for Directors”Directors” describe each director’s background and relevant experience in more detail.

| Director Skills and Experience |  |  |  |  |  |  |  |  |  | ||||||||

| Cybersecurity Mitigating risk through cybersecurity is a key area of |  |  |  |  |  |  |  | |||||||||

| |||||||||||||||||

| Leadership Our business is complex and ever-evolving. CEOs and individuals with experience leading large business units have proven track records in developing and executing a vision and making executive-level decisions. |  |  |  |  |  |  |  |  |  | |||||||

| |||||||||||||||||

| Finance and Accounting Individuals with financial expertise are able to identify and understand the relevant financial considerations applicable to us as a global public company. |  |  |  |  |  | |||||||||||

| |||||||||||||||||

| Technology/Software Industry Progress |  |  |  |  |  |  |  |  |  | |||||||

| |||||||||||||||||

| Go-to-Market/Sales Our business depends on successfully creating awareness of our products and entering new markets as well as executing our sales strategy. |  |  |  |  |  |  | ||||||||||

| |||||||||||||||||

| Strategy Development and execution of a strong corporate strategy is critical to sustaining and growing our business. |  |  |  |  |  |  |  |  |  | |||||||

| |||||||||||||||||

| Product Development Our business depends on our ability to successfully develop our products and expand our offerings. Experience in product development enhances understanding of the challenges we face and facilitates strategic planning in this area. |  |  |  |  |  | |||||||||||

| |||||||||||||||||

| Public Company Board Service and Governance Individuals having experience serving on public company boards better understand the roles and responsibilities of directors and corporate governance best practices. |  |  |  |  |  |  |  |  |  | |||||||

| |||||||||||||||||

| Mergers & Acquisitions A key element of our corporate strategy includes the acquisition of businesses that offer complementary products, services and technologies, augment our revenues and cash flows and meet our strict financial criteria. M&A experience enhances understanding of the complexities, issues and risks involved with any such acquisitions and their integration. |  |  |  |  |  |  |  |  |  | |||||||

| Human Capital Management Progress is driven by our people, so expertise in human capital management and related issues is critical to our long-term success. |  |  |  |  |  | |||||||||||

| CSR/ESG Corporate social responsibility is an integral part of |  |  |  |  |  |  | ||||||||||

| 2023 Proxy Statement | 19 |

Proposal 1: Election of Directors

Board Diversity Matrix 2021 and 2022

| As of March 29, 2023 | ||||

| Total Number of Directors | 9 | |||

| Part I: Gender Identity | Female | Male | ||

| Directors | 3 | 6 | ||

| Part II: Demographic Background | ||||

| African American or Black | - | - | ||

| Alaskan Native or American Indian | - | - | ||

| Asian | 1 | 1 | ||

| Hispanic or Latinx | - | - | ||

| Native Hawaiian or Pacific Islander | - | - | ||

| White | 2 | 5 | ||

| Two or More Races or Ethnicities | - | - | ||

| LGBTQ+ | 1 | |||

The above table is intended to comply with the format suggested by Nasdaq (See Nasdaq Rules 5605(f) and 5606). None of our directors declined to disclose their gender or demographic background. The information reported in the above table is unchanged from the information previously disclosed at https://investors.progress.com/board-progress-diversity-matrix as of July 22, 2022.

Having an independent Board is a core component of our governance philosophy. Our Corporate Governance Guidelines provide that, as a matter of policy and consistent with applicable laws, rules and regulations, a majority of the Board should be independent directors, as defined by the Nasdaq Stock Market Marketplace Rules. To help ensure independence, our Corporate Governance Guidelines contain limits on director outside activities. Directors are expected to avoid any action, position or arrangement that conflicts with an interest of the Company or gives the appearance of a conflict. Directors who also serve as CEOs or in equivalent positions should not serve on more than two boards of public companies in addition to the Board, and other directors should not serve on more than four other boards of public companies in addition to the Company’s board.

Based on the review and recommendation of our Nominating and Corporate Governance Committee, our Board has determined that all current directors except Yogesh Gupta (our President and Chief Executive Officer) are independent within the meaning of the director independence standards of the Nasdaq Stock Market, LLC (“Nasdaq”) and the applicable rules of the SEC.

| 20 |  |

Proposal 1: Election of Directors

|  | ||||

| |||||

|

Director Chair since

Committees: Nominating and Corporate Governance | ||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||

Background: Mr. Egan is managing partner of Carruth Management, LLC, a Boston-based venture capital fund he founded in October 1998 that specializes in technology and Other Current Public Company Boards:

Prior Public Company Boards in Last 5 Years:

| |||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Skills and Experiences: |  |  |   |  |  |   | CSR/ESG | |||||||||||||||||||

| Leadership |  | Finance and Accounting | |||||||||||||||||||||||

| Technology/ Software Industry |  | Go-to-Market/ Sales |  | Strategy |  | Public Company Board Service and Governance | |||||||||||||||||||

| M&A |

| 2023 Proxy Statement | 21 |

Proposal 1: Election of Directors

Director Since: Age: 65 Current Board Nominating and Corporate Governance (Chair) | |||||||||||||

| Paul T. Dacier | ||||||||||||

| Independent | |||||||||||||

Background: Mr. Dacier is currently the General Counsel of Indigo Agriculture, Inc., a Boston-based agricultural technology start-up company that specializes in products designed to maximize crop health and productivity, which he joined in March 2017. Previously, Mr. Dacier was the Chief Legal Officer of EMC Corporation from 1990 until September 2016, when EMC was acquired by Dell Technologies. Mr. Dacier was responsible for the worldwide legal affairs of EMC and its subsidiaries and oversaw the Other Current Public Company Boards:

Prior Public Company Boards in Last 5 GTY Technology Holdings, Inc. | |||||||||||||

| Skills and Experiences: |  | Leadership |  | Cybersecurity |  | Strategy |  | M&A | |||||

| Public Company Board Service and Governance |  | Technology/ Software Industry |  | Human Capital Management |  | CSR/ESG | ||||||

| 22 |  |

Proposal 1: Election of Directors

|

Director

Committees: Audit; Mergers and Acquisitions/Strategy | ||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||

Background: Dr. Gawlick Other Current Public Company Boards:

Prior Public Company Boards in Last 5 Years: None | |||||||||||||||||||||||||||||||||||||||

|  | Cybersecurity |  | Product Development |  | CSR/ESG |  | Leadership | ||||||||||||||||||

|  |  |  |  |  |  | ||||||||||||||||||||

| Finance and Accounting |  | Technology/ Software Industry |  | Go-to-Market/ Sales |  | Strategy | |||||||||||||||||||

| Public Company Board Service and Governance |  | M&A |

| 23 |

Proposal 1: Election of Directors

Director Since: Age: 62 | |||||||||||||

| Yogesh Gupta | |||||||||||||

| President and Chief Executive Officer | |||||||||||||

Background: Mr. Gupta became our President and Chief Executive Officer in October 2016. Prior to that time, Mr. Gupta served as an advisor to various venture capital and private equity firms from October 2015 until September 2016. Prior to that time, Mr. Gupta was President and Chief Executive Officer at Kaseya, Inc., a provider of IT management software solutions, from June 2013 until July 2015, at which time, Mr. Gupta became Other Current Public Company Boards:

Prior Public Company Boards in Last 5 Years: None | |||||||||||||

| ||||||||||||||||||||||||||

| Skills and Experiences: |  |  |   |  |  |   | Public Company Board Service and Governance |  | Human Capital Management |  | CSR/ESG | |||||||||||||||

| Leadership |  | Finance and Accounting |  | Technology/ Software Industry |  | Go-to-Market/ Sales | |||||||||||||||||||

| Strategy |  | Product Development |  | M&A |

| 24 |  |

Proposal 1: Election of Directors

Director Since: Age: 65 Current Board Audit (Chair); | |||||||||||||

| Charles F. Kane | ||||||||||||

| Independent | |||||||||||||

Background: Mr. Kane is currently Other Current Public Company Boards:

● Symbotic Robotics (Nasdaq: SYM), a robotics hardware and software

Prior Public Company Boards in Last 5 Years:

● Realpage, Inc. | |||||||||||||

| Skills and Experiences: |  | Cybersecurity |  | Go-to-Market/ Sales |  | Product Development |  | Human Capital Management | |||||

| CSR/ESG |  | Leadership |  | Finance and Accounting |  | Technology/ Software Industry | ||||||

| Strategy |  | Public Company Board Service and Governance |  | M&A | ||||||||

| 2023 Proxy Statement | 25 |

Proposal 1: Election of Directors

|

Director

Committees: Audit; Mergers and Acquisitions/Strategy (Chair) | ||||||||||||||||||||||||||||||||||||||

|  |  |  |  |  |  | |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||

Background: Ms. King is currently Chief Executive Officer of Veracode, Inc., a leading provider of application security Other Current Public Company Boards: ● ZeroFox Holdings, Inc. (Nasdaq: ZFOX), a leading external cybersecurity provider Prior Public Company Boards in Last 5 Years: None | |||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Skills and Experiences: |  |  |   |  |  | |||||||||||||||||||||

| Public Company Board Service and Governance |  | Human Capital Management |  | Leadership | |||||||||||||||||||||

| ||||||||||||||||||||||||||

| Finance and Accounting |  | Technology/ Software Industry |  | Go-to-Market/ Sales |  | Strategy | |||||||||||||||||||

| Product Development |  | M&A | |||||||||||||||||||||||

| 26 |  |

Proposal 1: Election of Directors

Director Since: Age: 62 Current Board Compensation (Chair) | |||||||||||||

| David A. Krall | |||||||||||||

| Independent | |||||||||||||

Background: Mr. Krall has served as a strategic advisor to Roku, Inc. (Nasdaq: ROKU), a leading manufacturer of media players for streaming entertainment, since January 2011. From February 2010 to December 2010, he served as President and Chief Operating Officer of Roku, where he was responsible for managing all functional areas of the company. Prior to that, Mr. Krall spent two years as President and Chief Executive Officer of QSecure, Inc., a privately held developer of secure credit cards based on micro-electro-mechanical system technology. From 1995 to July 2007, he held a variety of positions of increasing responsibility and scope at Avid Technology, Inc. (Nasdaq: AVID), a publicly traded leading provider of digital media creation tools for the media and entertainment industry. His tenure at Avid included serving seven years as the Other Current Public Company Boards:

Prior Public Company Boards in Last 5 Years:

| |||||||||||||

| Mergers & Acquisitions |  | Leadership |  | Technology/ Software Industry |  | Strategy | ||||||

| Product Development |  | Public Company Board Service and Governance | ||||||||||

| 2023 Proxy Statement | 27 |

Proposal 1: Election of Directors

|

Director

Committees: Compensation; Mergers and Acquisitions/Strategy | ||||||||||||||||||||||||||||||||||||||

|  |  |  | ||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||

Background: Ms. Tucci Other Current Public Company Boards: None

Prior Public Company Boards in Last 5 Years: None | |||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Skills and Experiences: |  |  |  |  |  | |||||||||||||||||||||

| Leadership |  | Public Company Board Service and Governance |  | Mergers & Acquisitions |  | Go-to-Market/Sales | |||||||||||||||||||

| Technology/ Software Industry |  | Strategy | |||||||||||||||||||||||

| 28 |  |

Proposal 1: Election of Directors

Director Since: Age: 69 Current Board Compensation; Nominating and Corporate Governance | |||||||||||||

| Vivian Vitale, NACD.DC | ||||||||||||

| Independent | |||||||||||||

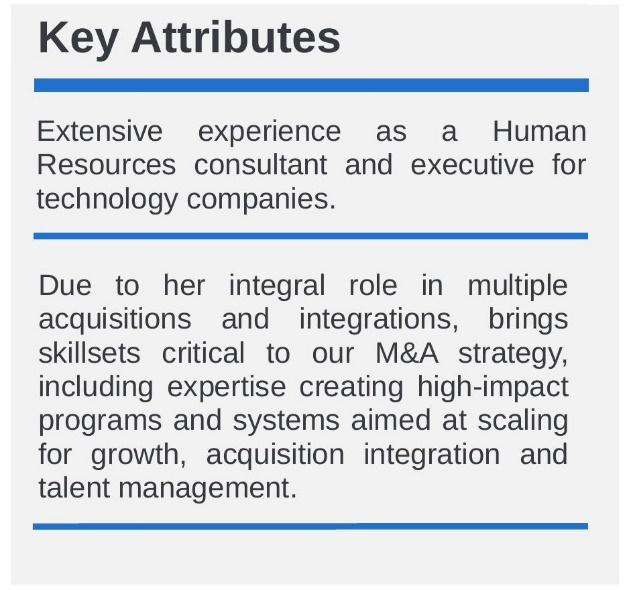

Background: Ms. Vitale owns and operates Vivian Vitale Consulting, LLC, a consulting practice assisting organizations in the development of human resources and people management practices, a role she has held since April 2018. From April 2012 until March 2018, she held multiple positions of increasing responsibility at Veracode, Inc., a provider of application security testing. Her tenure at Veracode included serving as Executive Vice President of Human Resources, continuing in her role through Veracode, Inc.’s acquisition by CA Technologies in March 2017. Prior to 2012, Ms. Vitale served as Senior Vice President at Care.com, Inc., an online provider of support services to families. Previously, Ms. Vitale has also held senior leadership roles at RSA Security, Unica Corporation and IBM. Ms. Vitale Corporate Directors NACD Directorship Certified ® since December 2022. Other Current Public Company Boards:

Prior Public Company Boards in Last 5 Years: None | |||||||||||||

| Skills and Experiences: |  | Cybersecurity |  | CSR/ESG |  | Leadership |  | Technology/Software Industry | |||||

| Strategy |  | Public Company Board Service and Governance |  | M&A |  | Human Capital Management | ||||||

| 2023 Proxy Statement | 29 |

Our Corporate Governance Framework

We believe we have in place corporate governance processes and practices that are designed to promote and enhance the long-term interests of our shareholders, solidify board oversight, strengthen management accountability and foster responsible decision-making. We regularly monitor developments in corporate governance and review our processes and practices in light of such developments.

Boards are accountable toshareholders

| Boards should be responsive toshareholders and be proactivein order to understand theirperspectives

| |||||

| Boards should adopt structures and practices that enhance their effectiveness | ||||

|

| |||

Boards should havestrong, independentleadership

| Shareholders shouldbe entitled to votingrights in proportion totheir economic interest

| Boards should developmanagement incentivestructures that are alignedwith the long-term strategyof the company

| ||||||||

| 30 |  |

Corporate Governance

Our Corporate Governance Documents

● Certificate of Incorporation ● Amended and Restated Bylaws ● Audit Committee Charter Nominating and Corporate Governance ● Nominating and Corporate Governance Committee Charter ● Compensation Committee Charter | ● Code of Conduct and Business Ethics ● Finance Code of Ethics ● Corporate Governance Guidelines ● Stock Option Grant Policy |

Our Certificate of Incorporation and our Bylaws are filed with the SEC and are available electronically at www.sec.gov. The other documents listed above can be found on our website at www.progress.com under the heading “Corporate Governance” located on the “Investor Relations” page. Any substantive amendment to or waiver of any provision of the Code of Conduct and Business Ethics may be made only by the Board and will be disclosed as required by Nasdaq listing standards or applicable law.

Our Corporate Governance Practices

Our Board is Independent

| 8 of 9 nominees areindependent | If the director nominees are elected at the Annual Meeting, the Board will continue to be composed of one employee director (Mr. Gupta, our CEO) and eight independent, non-employee directors (Messrs. Egan, Dacier, Kane and Krall, Dr. Gawlick and Mses. King, Tucci and Vitale). |

| Regular executive sessions ofindependent directors | Our independent directors meet in executive session without the Chief Executive Officer at every regularly scheduled Board meeting to discuss, among other matters, the performance of the Chief Executive Officer. |

| Committees areindependent | Each of the Board’s committees is strictly comprised of independent directors. |

| Independent compensationconsultant | The compensation consultant is retained by and reports directly to the Compensation Committee. The compensation consultant is independent of the Company and management. |

| 2023 Proxy Statement | 31 |

Corporate Governance

We Have Strong Board Refreshment

We believe it is important to maintain a mix of longer-tenured, experienced directors, who can help to preserve continuity and institutional knowledge, and new directors, who can provide fresh perspectives. In furtherance of this objective, the Board elected Mr. Dacier and Dr. Gawlick in June 2017, Mses. King and Tucci in February 2018 and Ms. Vitale in October 2019. We do not impose director tenure limits, although our Corporate Governance Guidelines do impose a mandatory retirement age of eighty-five. We believe our current Board composition strikes an appropriate balance between directors with deep historical knowledge of the Company and those with a fresh viewpoint.

|  |  |

June 2017 Paul T. Dacier – Rainer Gawlick – | February 2018 Samskriti Y. King – Angela T. Tucci – | October 2019 Vivian Vitale – |

| 32 |  |

Corporate Governance

We Have an Independent Board Chair

We believe the current Board leadership structure serves us and our shareholders well by having a strong independent Board isChair to provide independent leadership of the Board and because it allows our CEO to focus primarily on the Company’s business strategy, operations and corporate vision. This leadership structure, coupled with a core componentstrong emphasis on Board independence, provides effective independent oversight of management. Board members have complete access to and are encouraged to utilize members of our governance philosophy. senior management regularly, and they have the authority to retain independent advisors as they deem necessary. The Board believes this leadership structure affords our company an effective combination of internal and external experience, continuity and independence.

John R. Egan | Key Responsibilities of the Independent Board Chair: ● Calling meetings of the Board and independent directors; ● Setting the agenda for Board meetings in consultation with the CEO and our Secretary; ● Chairing executive sessions of the independent directors; ● Engaging with shareholders; ● Acting as an advisor to Mr. Gupta on strategic aspects of the CEO role with regular consultations on major developments and decisions likely to interest the Board; and ● Performing other duties specified in the Corporate Governance Guidelines or assigned by the Board. |

Mr. Egan currently serves as our independent Board Chair and brings extensive board leadership experience as a current director of publicly traded companies, including EMC Corporation, VMWare, Inc., Verint Systems and NetScout Systems, Inc., where he serves as Lead Director. Mr. Egan also holds a variety of leadership roles within the boards of directors of several privately held technology companies, including HighRoads Corporation, Platform Computing Corporation and Healthrageous, Inc. Mr. Egan has led global technology companies through strategic growth and operational change. His strong integrity and professional credibility with the other directors and executive officers has helped Mr. Egan to effectively oversee management and execute on the Company’s business strategy.

Our Corporate Governance Guidelines providedo not require the separation of the roles of Board Chair and Chief Executive Officer, as our Board believes that it is important that the Board retain flexibility to determine whether these roles should be separate or combined based upon the Board’s assessment of the Company’s needs and Progress’s leadership at a given point in time. We believe that an effective board leadership structure is highly dependent on the experience, skills and personal interaction between those in leadership roles. Our policy is to have a Lead Independent Director if the Board Chair is not independent.

| 2023 Proxy Statement | 33 |

Corporate Governance

We Proactively Engage with our Shareholders

We actively seek to engage with our shareholders as part of our corporate governance cycle. During the past year, members of senior management spoke to, or sought to engage with, a matterlarge cross-section of policy and consistentour shareholders. While approximately 49% of our outstanding shares are held by passive investors that do not participate in traditional engagements, our investor relations team has engaged with applicable laws, rules and regulations, a majoritythe ESG departments at the largest of these passive investment firms.

Our stockholder

| We reached out to shareholders representing:

| We met with

This represents ~84% of outstanding stock held by active shareholders since 49% our shares are held by passive investors | Topics discussed

|

| Investor Relations Outreach | ||

| We conduct a proactive, year-round investor outreach program with existing shareholders and potential investors, with whom we engage both passively (by responding promptly to inbound queries) and actively (through outbound solicitation). Our outreach program is run by our Investor Relations Department, and our CEO and CFO regularly participate in investor meetings. We routinely attend investor conferences, participate in non-deal roadshows and host meetings with investors at their request or by our invitation. We aim to maintain a consistent dialog with portfolio managers, analysts and ESG contacts at all institutional investment funds that own 0.5% or more of our shares. However, our Investor Relations Department communicates with current and potential investors of all sizes and we routinely engage shareholders and potential investors on matters pertaining to ESG and related topics. | |||

| How to Communicate with Our Board | ||

| Our Board of Directors welcomes communications from shareholders. Any stockholder may communicate either with our Board as a whole, or with any individual director, by sending written communications addressed to the Board of Directors or to such director at our offices located at 15 Wayside Road, Suite 400, Burlington, Massachusetts 01803, or by submitting an email communication to BOD@progress.com. All good-faith communications sent to our Board of Directors will be forwarded to the full Board or to the individual director to whom such communication was addressed. | |||

| 34 |  |

Corporate Governance

Our Board Evaluates Its Effectiveness

Our Board of Directors conducts periodic self-evaluations to determine whether the Board is functioning effectively. In addition, each committee of the Board shouldalso conducts a self-assessment of its performance and its members’ effectiveness relative to the goals and standards set forth in each committee’s charter. The Nominating and Governance Committee leads these evaluations and is responsible for reporting the results to the full Board and management. Directors may be independent.

Committees of the Board of Directors

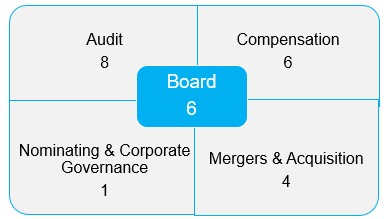

Our Board of Directors has standing Audit, Compensation, Nominating and Corporate Governance and Mergers and Acquisitions/Strategy Committees.

| Director | Audit | Compensation | Nominating and Corporate Governance | Mergers and Acquisitions/ Strategy | ||||

| John R. Egan |  | |||||||

| Paul T. Dacier |  | |||||||

| Rainer Gawlick |  |  | ||||||

| Yogesh Gupta | ||||||||

| Charles F. Kane |  |  | ||||||

| Samskriti (Sam) Y. King |  |  | ||||||

| David A. Krall |  | |||||||

| Angela T. Tucci |  |  | ||||||

| Vivian Vitale |  |  |

Chair

Chair  Member

Member

The Committee Charters adopted by our Board has determined that all current directors except Yogesh Gupta (our Presidentof Directors can be found on our website at www.progress.com under the heading “Corporate Governance” located on the “Investor Relations” page.

| 2023 Proxy Statement | 35 |

Corporate Governance

| Audit Committee | |||

Members Charles F. Kane (Chair) | Principal Responsibilities: ● Assists our Board of Directors in fulfilling its oversight responsibilities foraccounting and financial reporting compliance ● Appoints, compensates, retains and oversees the work performed by ourindependent registered public accounting firm for the purpose of preparing or issuing an audit report or related work ● Reviews the independent registered public accounting firm’s fees for servicesperformed ● Reviews with the independent registered public accounting firm, theCompany’s internal audit and financial management and the integrity of the Company’s internal and external financial reporting processes and the adequacy and effectiveness of the Company’s internal controls over financial reporting ● Reviews with management various matters related to our internal controls and legal, compliance and regulatory matters ● Reviews with management and the independent registered public accountingfirm the annual audited financial statements and the quarterly financial statements, prior to the filing of reports containing those financial statements with the SEC ● Reviews with management policies with respect to our risk assessment andrisk management, including appropriate guidelines and policies to govern the process, as well as the steps management has taken to monitor and control those risks ● Is responsible for producing the Audit Committee Report included in thisProxy Statement Our Board of Directors has determined that each member of the Audit Committee meets the independence requirements promulgated by Nasdaq and the SEC, including Rule 10A-3(b)(1) under the Exchange Act. In addition, our Board of Directors has determined that each member of the Audit Committee is financially literate, and that Mr. Kane qualifies as an “audit committee financial expert” under the rules of the SEC. | ||

| 36 |  |

Corporate Governance

| Compensation Committee | |||

Members David A. Krall (Chair) | Principal Responsibilities: ● Oversees our overall compensation structure and benefits, policies andprograms ● Administers our equity-based plans ● Reviews and makes recommendations to our Board of Directors regarding the performance of our Chief Executive Officer ● Reviews and recommends to our Board of Directors for its approval, the compensation of our Chief Executive Officer ● Consults with our Chief Executive Officer to review and determinecompensation of all of our other executive officers ● Assists in developing and reviewing succession plans for our seniormanagement, including the Chief Executive Officer ● Review our policies, programs and initiatives for inclusion and diversity,and provide guidance to our Board of Directors and management on these matters ● Reviews our processes and procedures for the consideration anddetermination of director and executive compensation ● Is responsible for producing the Compensation Committee Report included inthis Proxy Statement Our Board of Directors has determined that each member of the Compensation Committee meets the independence requirements promulgated by Nasdaq. | ||

Compensation Committee Interlocks and Chief Executive Officer)Insider Participation

The members of our Compensation Committee for fiscal 2022 were Mr. Krall and Mses. Tucci and Vitale, with Mr. Krall serving as Chair. Mr. Krall, Ms. Tucci and Ms. Vitale are independent within the meaningnot, nor have they ever been, an officer or employee of our company or of any of its subsidiaries or had any relationship with us requiring disclosure in this Proxy Statement. There are no compensation committee interlocks amongst any of our directors.

| 2023 Proxy Statement | 37 |

Corporate Governance

| Nominating and Corporate Governance Committee | |||

Members Paul T. Dacier (Chair) | Principal Responsibilities: ● Responsible for identifying qualified candidates for election to our Board ofDirectors and recommending nominees for election as directors at the Annual Meeting ● Assists in determining the composition of our Board of Directors and itscommittees ● Assists in developing and monitoring a process to assess the effectivenessof our Board of Directors ● Assists in developing and implementing our Corporate GovernanceGuidelines ● Assists in U.S. federal security clearance and government contracting matters The Board of Directors has determined that each member of the Nominating and Corporate Governance Committee meets the independence requirements promulgated by Nasdaq. | ||

| Mergers and Acquisitions/Strategy Committee | |||

Members Samskriti Y. King (Chair) | Principal Responsibilities: ● Reviews and provide guidance to Company’s management and the Board onthe Company’s merger and acquisition strategy as part of overall corporate strategy. ● Assists management in the review of acquisition transactions to be broughtbefore the Board and the review of our corporate strategy ● Reviews and evaluates the performance and integration of completedtransactions. ● Makes regular reports to the Board concerning areas of the Committee’sresponsibility. The Board of Directors has determined that each member of the Mergers and Acquisitions/Strategy Committee meets the independence requirements promulgated by Nasdaq. | ||

| 38 |  |

Corporate Governance

Role of the director independence standardsBoard

The Board is elected by shareholders. Except for those matters reserved for stockholder approval, the Board is the ultimate decision-making body of the Nasdaq Stock Market, LLC ("Nasdaq")Company. The Board advises and the applicable rules of the SEC. In making this determination, we solicited information from eachguides senior management and monitors its performance.

The fundamental role of the directors regarding whetheris to exercise their business judgment to act in what they reasonably believe to be the best interests of the Company and its shareholders. In fulfilling that director, or any memberresponsibility, the directors may rely on the honesty and integrity of his or her immediate family, hadthe Company’s senior management and on legal, accounting, financial and other advisors.

Strategic Oversight

Our Board delegates substantial authority in certain areas to the Company’s CEO and senior management enabling and trusting them to run the Company. The Board remains responsible however for overseeing management’s performance within the delegated areas including: strategic initiatives, financial performance, accounting and financial reporting, risk management and compliance.

Our Board engages with the Company’s management regularly and plays a direct or indirect material interestvital role informing management’s understanding of the Company’s strategic objectives and performance drivers while ensuring proper focus on the risks associated with those corporate strategies and continually evaluating the level of authority delegated to management to ensure that it is reasonable.

| 2023 Proxy Statement | 39 |

Corporate Governance

Our Board of Directors Has a Significant Role in any transactions involvingRisk Oversight

Our Board of Directors believes that its oversight responsibility with respect to the various risks confronting our company was involved in a debt relationship withis one of its most important areas of responsibility and provides further checks and balances on our company or received personal benefits outsideleadership structure. Our Board of Directors views its oversight of risk as an ongoing process that occurs throughout the scope ofyear while evaluating the director’s normal compensation. We considered the responses of the directors,strategic direction and independently considered the commercial agreements, acquisitions and other material transactions entered by us during 2020, and determined that noneactions of our non-employee directors hadcompany. A fundamental aspect of risk management is not only understanding the risks a material interest incompany faces and what steps management is taking to manage those transactions.risks, but also determining what level of risk is appropriate for the Company. We believe that having an independent Board Chair enhances our Board’s ability to oversee our risks.

| In carrying out this critical function, our Board is involved in risk oversight through direct decision-making authority with respect to significant matters and the oversight of management directly by our Board and through its committees. Each committee’s specific area of responsibility as it relates to risk management is as follows: |

|  |  |  | |||||||||||

Audit Committee ● Financial condition,financial statements and financial reporting process ● Internal controlsand accounting matters ● Cybersecurity matters ● Conflict of interestissues and compliance with legal and ethical standards | Compensation ● Overallcompensation practices, policies and program design ● Inclusion anddiversity initiatives ● Human capitalmanagement considerations | Nominating and Corporate Governance Committee ● Corporate governancepractices ● Leadership structureof the Board ● Director andmanagement succession planning ● U.S. federal securityclearance and government contracting matters | Mergers & Acquisitions / Strategy Committee ● Review of overallcompany strategy ● Acquisitions andother strategic transactions | |||||||||||

| Our Board of Directors receives reports from members of senior management on the functional areas for which they are responsible. These reports may include information concerning operational, financial, sales, competitive, legal and regulatory, strategic and other risks, as well as any related management and mitigation. |

| Board Oversight of ESG | ||

| With rising expectations from investors, customers, employees and regulators related to environmental, social and governance issues (ESG), companies are increasingly taking action and implementing ESG initiatives. It is the role of our Board to guide management in connecting the Company’s ESG efforts to the industry, markets, products and strategies that are unique to Progress in order to ensure such efforts are aligned with the best interests of our stakeholders. | |||

| 40 |  |

Corporate Governance

| Oversight of Cybersecurity | ||

| A key area of focus for us is our risk mitigation practices around cybersecurity risk. Cybersecurity protection is vital to our organization and our stakeholders, and we are committed to ensuring that our products, data and systems are secure from potential breach. Our cybersecurity governance team provides periodic updates to the Board and quarterly updates to the Audit Committee on cybersecurity matters, including information about cybersecurity governance processes, the status of projects to strengthen internal cybersecurity and security features of the products and services we provide our customers. Our cybersecurity program includes external audits of our internal and product security practices under top information security standards, including System and Organization Controls (SOC) 2, Health Insurance Portability and Accountability Act of 1996 and Payment Card Industry Data Security Standard. We have implemented a comprehensive cybersecurity training program for all employees, and we have taken steps to mitigate the impact of potential cybersecurity risks, including by procuring a separate cyber insurance policy as part of our comprehensive corporate insurance program. | |||

Director Attendance

Our Board of Directors met sixfive times during the fiscal year ended November 30, 2020.2022. During fiscal 2020,2022, each director nominee attended at least 75% of the aggregate of the total number of meetings of our Board of Directors and the total number of meetings of all committees of our Board of Directors on which he or she served from and after his or hertheir election to the Board.

In January 2018, the Board of Directors adopted a policy requiring members of our Board of Directors to attend the Annual Meeting of Stockholders.Shareholders. All of the members of our Board of Directors virtually attended the 20202022 Annual Meeting of Stockholders.

5 meetings in 2022 Our Board holds five regular meetings a year, with special meetings occurring when necessary. 2022 Regular Board Meetings:

| Each director attended at least 75% of the total number of meetings of our Board and the Committees on which he or she served during their respective term of service during 2022. In addition, all directors attended our 2022 Annual Meeting of Shareholders. | |||||

|

| Our Board’s organizational meeting follows our annual meeting of shareholders. Our Board meets in executive session at every regularly scheduled Board meeting, which is followed by a session of only independent directors led by the Chair. Directors are expected to attend Board meetings, meetings of the Committees on which they serve and our annual meeting of shareholders, with the understanding that on occasion a director may be unable to attend a meeting. |

Executive Sessions of Independent Directors

The independent directors of the Board of Directors

| Director | Audit | Compensation | Nominating and Corporate Governance | Mergers and Acquisitions/Strategy | ||||||||||

| John R. Egan | Member | |||||||||||||

| Paul T. Dacier | Chair | |||||||||||||

| Rainer Gawlick | Member | Member | ||||||||||||

| Yogesh Gupta | ||||||||||||||

| Charles F. Kane | Chair | Member | ||||||||||||

| Samskriti (Sam) Y. King | Member | Chair | ||||||||||||

| David A. Krall | Chair | |||||||||||||

| Angela T. Tucci | Member | Member | ||||||||||||

| Vivian Vitale | Member | Member | ||||||||||||

| Number of meetings in fiscal year 2020 | 8 | 6 | 1 | 4 | ||||||||||

| 2023 Proxy Statement | 41 |

We pay our non-employee directors a mix of cash and equity compensation. Employee directors receive no compensation for their service as directors.

In accordance with the 20202022 Director Compensation Plan adopted by the Board, for 2020,2022, our non-employee directors were paid an annual retainer of $250,000. This annual retainer$275,000, of which $50,000 was paid $50,000 in cash and $200,000$225,000 in equity in the form of deferred stock units (“DSUs”). The independent Chairman ofCommittee members and chairs also received the Board was paid an additional cash retainer of $50,000. The cash portions of the annual retainers were paid in June 2020.

| ANNUAL RETAINER | ADDITIONAL ANNUAL CASH RETAINER | |

| Independent Board Chair Audit Committee Chair - $25,000 Members - $20,000 Nominating and Corporate Chair - $12,500 Members - $10,000 | Compensation Committee Chair - $25,000 Members - $15,000 Mergers and Acquisitions/Strategy Chair - $25,000 Members - $15,000 |

Prior to adopting the 20202022 Director Compensation Plan, the Compensation Committee received market data from itsPay Governance, the Compensation Committee’s independent compensation consultant, and considered whether any changes in director compensation were required.should be proposed. Based on the market data, the Compensation Committee recommended to the Board no changes to director compensation and the Board adopted this recommendation.

The cash retainers for Board and Committee services were paid in June 2022 and the equity retainers were issued in June 2022.

The number of DSUs granted was determined by dividing the equity retainer by the grant-date closing price of our common stock as reported by Nasdaq. The DSUs vest in a single installment on the date of the Annual Meeting, subject to continued service on our Board of Directors through such date. DSUs do not convert to shares of common stock until a director terminates service on the Board of Directors or upon a change in control, whichever occurs first.

| 42 |  |

Director Compensation Table—Fiscal 2020

| Name | Fees Earned or Paid in Cash ($) | Stock Awards (1)(2) ($) | Total ($) | ||||||||

| Paul T. Dacier | 62,500 | 200,035 | 262,535 | ||||||||

| John R. Egan | 110,000 | 200,035 | 310,035 | ||||||||

| Rainer Gawlick | 85,000 | 200,035 | 285,035 | ||||||||

| Charles F. Kane | 90,000 | 200,035 | 290,035 | ||||||||

| Samskriti Y. King | 95,000 | 200,035 | 295,035 | ||||||||

| David A. Krall | 75,000 | 200,035 | 275,035 | ||||||||

| Angela T. Tucci | 80,000 | 200,035 | 280,035 | ||||||||

Vivian Vitale(3) | 90,000 | 300,047 | 390,047 | ||||||||

Stock Ownership Guidelines